Keeping track of your bank balance is an important part of maintaining your financial health or tracking salary income and expenses.

If you are a FAB Bank customer, you will know that the bank offers various services to help you with your finances, including bank balance checks.

FAB Balance Check

So, in this blog post, we’ll see how to use the FAB Bank Balance Check facility to stay on top of your money. We will share the different ways to access this information, its importance along with the features and benefits of doing so.

What Is FAB Bank Balance Check?

FAB Bank Balance Check is an online facility provided by FAB Bank that allows customers to view their account balance and past transactions. It’s a simple and easy way to keep track of money coming in and going out of your account.

The Bank Balance Check service provides users with real-time updates on their account balances and transactions, making it easier to manage your finances.

For those who receive salary into their bank account, it is beneficial to use the FAB Bank Balance Check facility to ensure that the amount has been paid into your account.

FAB Bank Balance Check – Step-By-Step Guide

There are three most popular and easiest ways to access to check your FAB bank balance. One through the FAB Bank website, the second by using the FAB Mobile Banking app, and the third by visiting a FAB ATM.

Here is a step-by-step guide for each of these methods:

Method 1: How to Check FAB Bank Balance Online Using Official Website

If you don’t want to install the mobile app, you can use FAB Bank’s online banking service to check your balance.

Step 1: To do this, Visit FAB official website’s Prepaid Cards Enquiry page. and go to the card service page (link below). You will see two blank fields, which you have to fill and login to your account.

Step 2: Enter the last two digits of your FAB card in the first blank field.

Step 3: Once you have done this, fill the second box with the 16-digit card ID number. You can easily find it on your FAb card on the bottom of the front.

Step 4: After entering all the details, click on the ‘Login’ button.

Step 5: You will be redirected to your account page. Here you can check the total balance of your FAB bank account in real time.

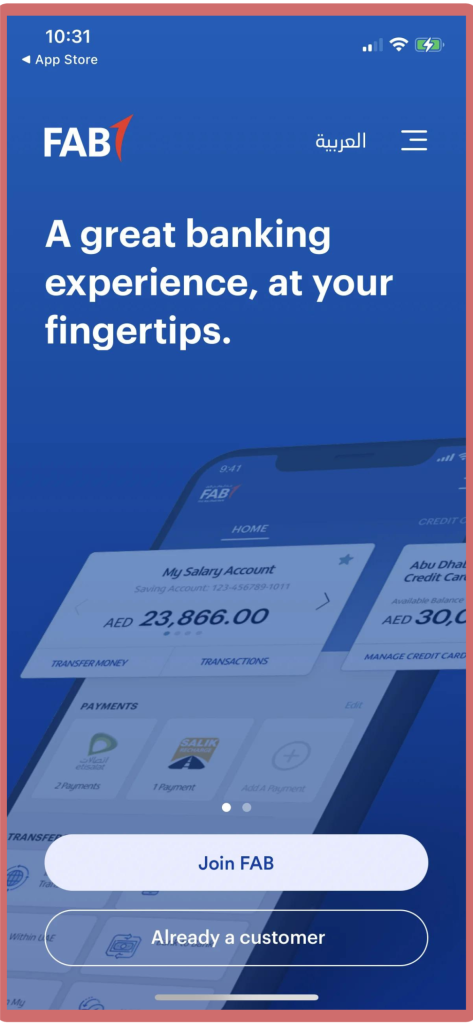

Method 2: How to Check FAB Bank Balance Online Using Mobile App

If you need to check your bank balance regularly, downloading the FAB Bank mobile app is recommended. You can find it on the iOS and Android app stores.

Step 1: Download the FAB Bank mobile app from your device’s app store. Here are the app download links for APP STORE (For iOS) and PLAY STORE (For Android).

Step 2: Once the app is installed open it on your device and login with your credentials. If you are using it for the first time, you will need to enter your customer ID or debit card number to distribute the password sent to your registered mobile number or email address, and subsequently use the login. A 6-digit PIN must be created for future use.

Step 3: After login, you can view your account balance on the home page.

Step 4: You can also view your past transactions and other details on the app.

Method 3. Using FAB Bank ATM

If you don’t have access to internet or mobile phone and are looking for an offline way to check your bank balance, you can use FAB Bank ATM.

Step 1: Visit any nearby FAB Bank ATM and insert your FAB Bank Debit Card.

Step 2: You will see several options like withdrawal, deposit etc. Select the ‘Check Balance’ option.

Step 3: You will be asked to enter your ATM PIN. Enter it, and you’ll see your bank balance on the screen.

FAB Bank Salary Account Balance Check

Are you a FAB Bank Salary Account Owner? Don’t worry, the process to check your bank balance is exactly the same as mentioned above.

FAB Bank offers a separate account for those who receive salary in their account. This is only to give you easy access to manage your salary and other financial activities, otherwise, the process of checking FAB Bank balance remains the same across all FAB Bank accounts.

You can use any of the above methods, but the easiest way is through their official website.

FAB Bank provides a prepaid card to every customer with a salary account, making it easy to cash out or transfer money to other bank accounts. You can also use prepaid cards to shop online, shop in stores and access various services.

With these card details, such as the last two digits of the card and the 16-digit card ID number, you can easily access your account and check your pay balance online.

How To Open FAB Bank Account?

If you want to open a FAB bank account, there are different types of accounts, such as salary, savings and current.

To open a bank account with FAB Bank, you have four options:

- Visit your nearest FAB Bank branch and fill the required form and submit it along with necessary documents.

- Fill the online application form on the FAB Bank website.

- Download the FAB Bank mobile app, fill in your details and submit it online to open your account.

- Call FAB Bank customer service and complete the application over the phone.

To open a bank account at FAB Bank, you need to verify your mobile number and provide necessary documents such as proof of identity and address.

Once your account is opened and activated, you will receive a FAB Bank debit card, which you can use to check balances, make ATM withdrawals or shop and pay online.

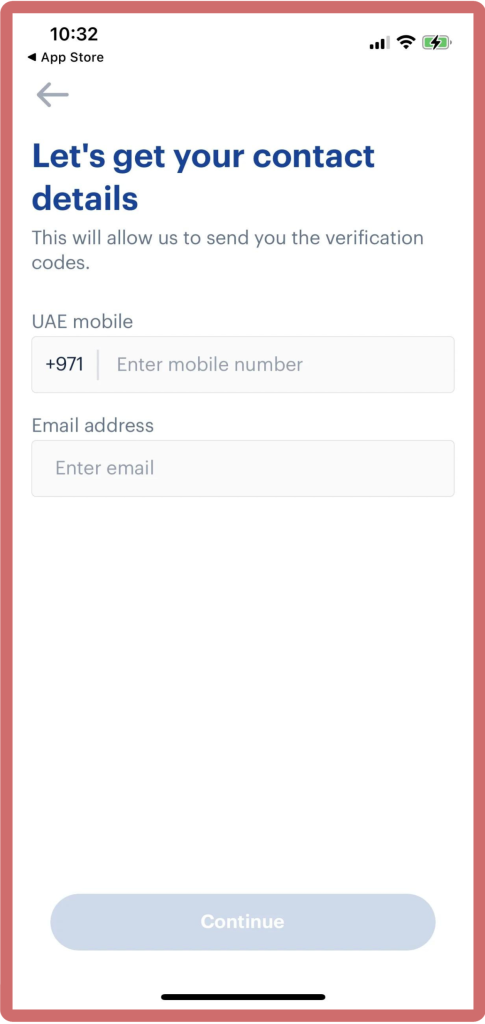

How To Activate FAB Mobile Banking?

To activate FAB Mobile Banking, you must have a valid FAB Bank Debit Card. If you have, you need to follow the following steps:

Step 1: Download the FAB Bank mobile app from your device’s app store. It is available on both iOS and Android.

Step 2: Open the app and register for mobile banking.

Step 3: You will need to provide your debit card details and OTP number sent to your registered mobile phone or email address.

Step 4: Create a new login password by following the on-screen instructions.

After completing the registration process, you can use the FAB Bank app to check your balance, transfer money and pay bills.

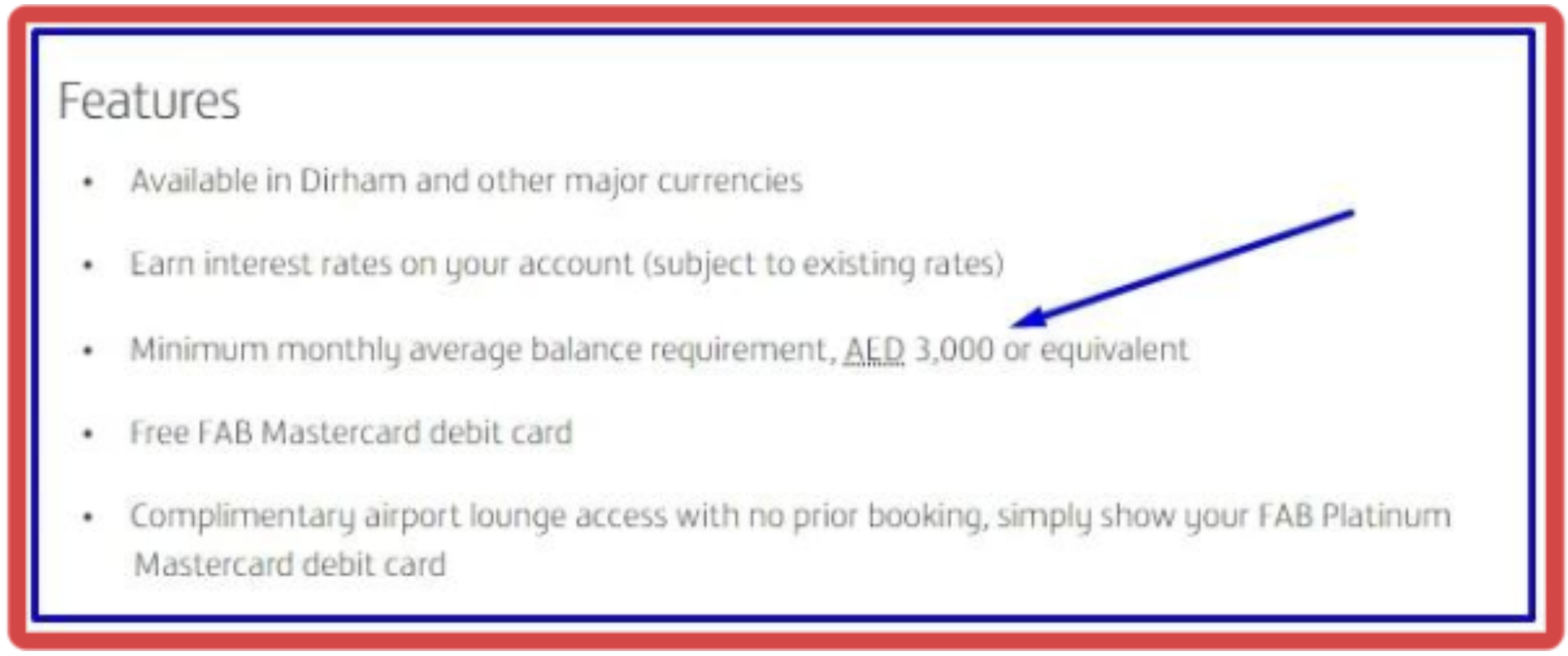

What Is The Minimum Balance In FAB Account?

There is no minimum balance requirement to maintain a FAB bank account. However, if you own a personal savings account with FAB Bank, there is a minimum balance of 3000 AED that you need to maintain.

If your account balance falls below AED 3000, you will be charged a monthly penalty of AED 10.

If you’re only using FAB Bank Account for cash deposits and withdrawals, you don’t need to worry about minimum balances. This is because the account you have in this situation is by default an Elite Savings account, which does not require you to maintain a minimum balance.

What Is FAB Swift Code?

SWIFT Code of FAB Bank is NBADAEAAXXX. SWIFT stands for Society for Worldwide Interbank Financial Telecommunications, and is a global organization that provides secure and reliable financial transaction services.

The code indicates the bank branch to which the money needs to be transferred. Each bank has its own unique SWIFT code used for domestic and international money transfers.

Whenever you send or receive money, you must provide the SWIFT code of the bank branch involved in the transaction.

FAB Customer Care Number

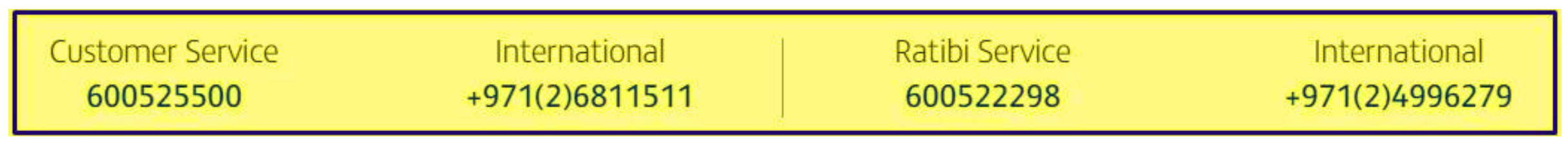

If you have any query regarding FAB Bank services, you can contact their customer care team. You can call them on 600525500 or contact them through their website.

However, do note that this number is only valid if you are in the UAE. If you are from abroad, you can call them on +971 2 6811511.

You can also contact them through social media like Facebook, Twitter, Instagram and LinkedIn. You can find their social media profiles on their website.

Advantages Of Using The FAB Balance Check Service

The FAB Balance Check service is a great way to monitor your bank account and keep track of your finances. It gives you real-time information about your balance so you can plan and budget accordingly.

The Service is very secure, using strong encryption technology to protect your information from unauthorized access and theft. Additionally, the service offers different ways to check your balance, such as online platforms and mobile banking.

You can always check whether your salary has been credited to your account if a deduction has been made, and when a transaction has been completed successfully.

Overall, the FAB Balance Check service offers a simple and secure way to keep track of your bank balance and ensure that your money is being used responsibly.

Benifits of checking FAB bank balance online

Convenience: It’s easy:just like 123 you no more need to standing in long lines or running to an FAB ATM to check how much money you have in your FAB bank account. With the official FAB bank website or mobile app, now you can easily check your FAB account balance from anywhere, anytime. No worries whether you’re at home, at work, or outside, If you have internet facility and your login details, you can check and manage your FAB account hassle-free.

Real Time Account Updates: When you need to check your bank, you will be able to get instant updates on your FAB account. Instead of old-fashioned methods such as monthly papers statements or ATM receipts may not provide you up-to-date information. But with a official website or FAB mobile app, you can instantly get any recent funds transfer, withdrawn, deposits or pending transactions updates, Which will ensuring you have an accurate information of your money in your account.

Advanced Security: Many banks have implemented strong security measures to protect their customers’ bank accounts and all kind of online transactions. By using their official webportals or mobile phone apps, You can be confident that your personal and financial information is confidential and secure. This high level of security provide you suareaty that your bank info is stays private and safe, and nobody can get in without permission.

Tips to keep your online banking secure

While it’s easy to check your FAB bank account online, It is important to ensure that all of your personal and financial details remain secure. Here are some important tips which helps you stay safe while using online banking:

Protect your devices

Make sure all your gadgets like computers, laptops, smartphones and tablets have the latest version of security software. You also need to install a good and reliable antivirus and anti-malware software which help you to protect against potential threats.

Creat a Tough Password

For your Fab Bank account you need to create a unique and strong password, Avoid using easily guessed words for password. Include a combination of upper and lower case letters, numbers and special characters. Update your passwords on regular basis and avoid using the same password for multiple accounts.

Stay away from public Wi-Fi

Stay away from public Wi-Fi networks like cafes, airports or malls when you’re checking your bank account. These networks are often not secure, and your private information may be at risk from hackers.Instead of public wifi networks you need to use a secure and private Internet connection, such as your home Wi-Fi or mobile phone data.

Monitor your account regularly

Check your bank account regularly for any unusual, suspicious or unauthorized transactions. If you see any suspicious transaction that you did not made, instantly report to FAB bank to prevent any further problems.

You may also read how to Check NBAD Bank Balance Inquiry.

FAQ’s

Q: 1 What is the minimum balance in FAB bank?

Answer: There is no minimum balance requirement in FAB Bank if you have a savings account provided by default. However, if you own a personal savings account with FAB Bank, there is a minimum balance of 3000 AED that you need to maintain.

Q: 2 What is the blocked amount in FAB?

Answer: Block money is a term used when your bank holds a portion of your balance for a specified period of time. This usually happens when you make a transaction, such as an ATM withdrawal or when you pay for something with your debit or credit card. This amount will be held until the transaction is processed.

Q: 3 How do I check my FAB bank statement?

Answer: You can check your FAB Bank statement online by logging into your account or by requesting a physical copy of the statement from FAB Bank. You can also check your statement through the mobile banking app.

Q: 4 Is there any charges to check my FAB bank balance?

Generally, checking your account online is free of cost. However, it is important to check your Bank’s terms and conditions or contact FAB Bank directly To ensure that there are no fees associated with certain transactions or services.

Q: 5 Can i check my transection history using FAB official website or mobile app?

Yes both the FAB bank website and mobile app usually offer options to view your transaction history. You can check details about past deposits, withdrawals and any other transactions to get a complete overview of your account activity.

Conclusion

Using the FAB Bank website or mobile phone app for FAB bank balance check, comes with many benefits such as convenience, real-time updates, and high level of security. You just need to follow the simple steps that we have discussed in this article, and you can easily get the information about your money in your FAB Bank account. Don’t forget to secure your devices and follow good security tips to ensure your banking experience remains secure.